home depot tax exemption certificate

Lowes s Tax Exempt number is 500277019. It will be given to the cashier whenever checking out at Home.

Home Depot Tax Exempt Fill Online Printable Fillable Blank Pdffiller

All registrations are subject to review and approval based on state and local laws.

. The property tax is an ad valorem tax meaning that it is based on the value of real property. Complete Pennsylvania Tax Exemption Certificate form listed above and include Lowes Tax Exempt number 500277019. Until then you can purchase from Home Depot with a temporary tax.

Without accounting for exemptions properties of equal value in the same community should pay the same. Enter your business information and click Continue. This number is different from your state tax exemption ID.

Lowes s tax exempt number is 500277019. Enter your official contact and identification details. Department of Veterans Affairs Veterans Administration Certificate of 100 Total and Permanent Disability while on Active Duty is still required by law.

It takes only a few minutes. Up to 7 cash back Hello Im Jiban Akhter and Ill help you to be tax-exempt against your business in 40 states. Otherwise Ill take care of the resale certificates for you.

Find the document you want in our library of legal templates. Easily follow these steps and start dropshipping using Home De. Phone number Make sure this phone number is registered to your Pro Xtra account.

If you have a resale certificate it will speed up the process. Keep to these simple instructions to get Home Depot Tax Exempt ready for sending. Real property commonly known as real estate is land and any permanent structures on it.

If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number. Open the form in the online editor. Property taxes are based on the value of real property.

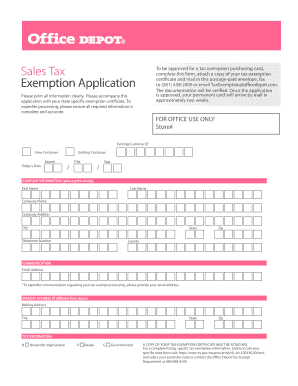

Sales Tax Exemption Application To be approved for a tax exemption purchasing card complete this form attach a copy of your tax-exemption certificate and mail in this postage-paid envelope fax to 561 438-2405 or email TaxExemption officedepot. Read through the recommendations to determine which info you will need to give. ET Monday through Friday View Tax Exempt Customer FAQs.

Our application is reviewed by Home Depot within 24-48 hours and the tax exemption status is granted permanently. If you qualify as a tax exempt shopper and already have state or federal tax ids register online for a home depot tax exempt id number. Here it is guys.

877 434-6435 Option 4 Option 6 9 am. Use e-Signature Secure Your Files. Home Depot takes 24-48 hours to review our application and to give us the permanent tax exemption status.

If you have any questions about Home Depot Tax Exemption please call The Home Depot Tax Department at 877 434-6435 Option 4 Option 6. If you already have a The Home Depot tax exempt ID skip to. This is different than your state-issued sales tax exemption number and should be easy to remember.

With respect to the 100 Totally and Permanently Disabled Veterans Property Tax Exemption it can begin after December 3 2020 assuming all other eligibility requirements are met. Select the fillable fields and put the necessary data. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

The out-of-state seller may accept this certificate as a substitute resale certificate and exempt the transaction from the states salesusetransaction tax but they are not required to accept it. Up to 7 cash back I will obtain your Tax ExemptionResale Certificate on your behalf. Up to 8 cash back The Home Depot Sites The Home Depot The Home Depot Canada The Home Depot Mexico Need help with your registration.

How to use sales tax exemption certificates in Oklahoma. To apply for a Tax ID you need to go to The Home Depots website here and provide the following information. Home Depot Tax Exemption Form.

A hold-your-hand video that will help you gain tax exemption from Home Depot. Dont file this form with us. Some states including Washington may require you to use their state-specific form.

Establish your tax exempt status. To shop tax free you need a Tax Exempt ID from The Home Depot. The required fields are marked with red asterisk marks.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Give the completed form to the out-of-state seller at the time of purchase. Home depot tax exemption application.

Ad Office Depot More Fillable Forms Register and Subscribe Now. Try it for Free Now. Upload Modify or Create Forms.

Home Depot allows you to select your own Home Depot tax ID. I will make your company sales tax exempt on Home Depot across all US States in a 100 legal way. Use your Home Depot tax exempt ID at checkout.

Home Depot Tax Exemption Application Youtube

How To Register For A Tax Exempt Id The Home Depot Pro

How To Register For A Tax Exempt Id The Home Depot Pro

How To Register For A Tax Exempt Id The Home Depot Pro

Do Home Depot Sales Tax Exemption By Rawal16 Fiverr

How To Register For A Tax Exempt Id The Home Depot Pro

How To Register For A Tax Exempt Id The Home Depot Pro

Home Depot Tax Exempt Fill Online Printable Fillable Blank Pdffiller

For Departments Procurement Services New Mexico State University

Help You Get Homedepot Tax Exempt All States The Legal Way By Ayoubhassab Fiverr